SUSTAINABILITY INSIGHTS

What are the Benefits of Sustainability?

Rise of Sustainability Reporting

The statistics around sustainable program adoption are staggering. Over 90% of the S&P 500 have at least one sustainability goal. 40% of the S&P 1200 can say the same. In the last three years, the UN Principles of Responsible Investment (UN PRI) has more than doubled its number of signatories to 4,000 investors that have over $120 trillion in assets under management (AUM). Odds are that you have heard about sustainability, or as it’s sometimes called ESG (environmental, social, governance), in one form or another. With the amount of attention it’s receiving, we’ll lay out the key benefits and what you “need to know” about sustainability.

Investor Rationale

In order to understand the benefits of sustainability, it’s important to know where it’s rooted. One of the primary causes of the 1929 Stock Market Crash was the widespread practice of selling stocks based on falsified or misleading information1. Since that time, regulations have been created to both protect investors and influence corporate behavior. Additionally, the reporting of financial data has matured to a point where companies understand what they are expected to faithfully disclose, and investors, employees and other interested parties comprehend the implications of said disclosures.

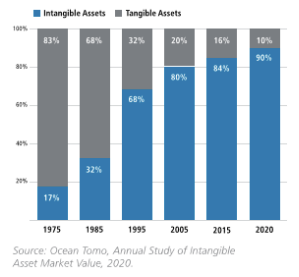

Since 1985, however, the ratio of tangible assets (plants, equipment, cash) to intangible assets (goodwill, brand-value, software) as a function of the market value of the S&P 500 has flipped (see chart).

The implications of this flip are easily understood: In 1975, you could review a corporate financial statement and produce an accurate valuation. In the year 2022, 90% of a corporation’s market value is intangible and this has created a tremendous demand among investors, employees, communities, and consumers for data that tells a more complete story a company’s activity.

Company’s are increasingly being asked to disclose information related to the impact of their operations on the environment, the impacts from the products they make, and the impacts of their supply chain participants.

The concept is broadly referred to as double materiality and means that companies are being asked to provide data that is both financially material as well as materially impactful to the environment or society at- large.

Organizations like the United Nations, Ceres and the World Resources Institute have elevated the importance of environmental and social issues and garnered international buy-in of frameworks like the United Nations Sustainable Development Goals (SDGs).

While most government regulators, including the US Securities and Exchange Commission (SEC), are still rationalizing how to address double materiality in corporate disclosures, there are some instances of adoption: In 2015, France passed the “Law on Energy Transition for Green Growth,” requiring all public companies to disclose their strategies for decarbonization.

The Role Governments Play

In addition to its regulatory role, government plays an important role in incentivizing and sparking innovation that helps drive down the costs and increase the accessibility of clean energy.

Since 2006, when the federal solar investment tax credit was enacted, the solar industry has grown 10,000%3, greatly reducing our nation’s dependency on fossil fuels to generate power.

In California, the California Public Utilities Commission (CPUC) has authorized over $1B in subsidizes as part of the self-generation incentive program, helping to transform the State into the world’s largest market distributed generation and energy storage4.

One of the more interesting cases highlighting the intertwined functions of government regulation and incentive involves the Environmental Protection Agency (EPA), the California Air Resources Board (CARB) and renewable natural gas (RNG). In 1996, the EPA created new emissions regulations for large landfills, requiring them to collect and combust landfill gas. The reasoning behind the regulation was logical enough – burning landfill gas converts methane to carbon dioxide, which is 25x less potent as it pertains to global warming. The 1996 regulations are the foundation for 75% of the country’s current RNG production.

CARB administers the nation’s largest and most aggressive low carbon fuel standard, requiring a 20% lowering of the overall carbon intensity (CI) of all transportation fuels used in California. The program, first implemented in 2010, has been one of the largest drivers in expanding demand for RNG as a vehicle fuel. As of the most recent quarterly report, CARB estimates that 98% of all natural gas vehicle fuel in California is RNG and the average CI of that fuel is -62.7. The negative CI score indicates that the entire “well to wheels” process including production, transportation and combustion removes more carbon from the atmosphere than the status quo baseline.

Three Things to Consider

In addition to societal and investor demand, and the impact of government policies and incentives, there are other important things to know about sustainability:

1. Encourages the Long-Term View

First and foremost, sustainability encourages the long-term view. Companies that choose to proactively manage their sustainable risks and opportunities are proven to outperform those that do not2. These include well discussed items like the operational risks presented by greenhouse gas regulations and the opportunities software firms have to enhance products in the area of user privacy. Whether you are a business, consumer, investor or employee, we are in a collectively better place when making informed decisions based on non-financial sustainable information.

2. Frameworks and Standards Are Maturing

Should a safety-conscious consumer purchase a Ford or a Toyota? What company makes a safer car? These questions illustrate the value in being able to make an apples-to-apples comparison of information. It’s been nearly 100 years since the 1929 Stock Market Crash and it’s easy to take for granted the accomplishments of organizations like the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) that enabled comparability across financial reports.

Sustainable reporting is still a new field, and there are multiple standards that are still evolving: Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI), Climate Disclosure Standards Board (CDSB), Task Force on Climate-related Financial Disclosure (TFCD), etc, etc.

Three recent events that should help the comparability of data are:

- The merger of SASB and <Integrated Reporting> to form the Value Reporting Foundation (VRF).

- The collaborative workplan announced by the VRF and the GRI to provide clarify on reporting standards.

- The announced consolidation of the CDSB with the VRF under the International Sustainability Standards Board (ISSB).

As frameworks and standards mature and corporate adoption increases, the decision usefulness and comparability of information will only increase.

3. Mandatory Regulation Is Coming

Outside of a few specific instances, sustainability reporting is currently a voluntary practice. However, as part of its mandate to protect investors and influence corporate behavior, the US Securities and Exchange Commission (SEC) recently unveiled its long- awaited climate disclosure proposal.

The proposal would require public companies to disclose their Scope 1 and Scope 2 emissions and, if material, their Scope 3 activity. While still in draft form, the proposal indicates that climate related disclosures are likely to be heading toward a mandatory requirement.

While environmental information is only one piece of the sustainability puzzle, but there is enough momentum built that we should begin to see the mass digitalization of commercial and industrial emissions information this year.

The Bottom Line

Companies exist to serve the needs of four major constituents: Investors, employees, consumers, and the communities they operate in. Increased communication regarding sustainability risks and opportunities and how a company plans to navigate them benefits each of those groups.

The fact that standards are evolving, and data is immature should not serve as the foundation to devalue the long-term view that sustainability management focuses on. As double materiality is rationalized by regulators and disclosure of sustainable data evolves from voluntary to mandatory, it will become more consistent and decision useful.

Government incentives will continue to play an outsized role in shaping markets and directing innovation. Firms that choose to proactively manage their operating environment and their unique opportunities and risks stand to thrive and prosper versus their peers.

March 2022