SUSTAINABILITY INSIGHTS

The New York Cap & Invest Program (NYCI)

Background

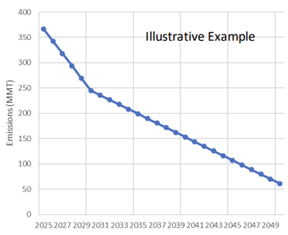

Signed into law on July 18, 2019, the New York Climate Leadership and Community Protection Act (CLCPA) set a legal requirement to reduce greenhouse gas (GHG) emissions by 40% in 2030 and 85% in 2050. The CLCPA regulatory implementation was tasked to the New York State Department of Environmental Conservation (DEC) and the New York State Energy Research and Development Authority (NYSERDA). The framework currently being developed to meet the CLCPA goals is the New York Cap & Invest program.

New York Cap & Invest (NYCI)

New York Cap & Invest (NYCI; pronounced Nicky) will establish the allowable GHG emissions each year in the state. The program will contain three separate sets of regulations that include:

- Mandatory GHG reporting.

- Mandatory purchasing of emissions allowances.

- An auction to set the price for allowances.

NYCI will incentivize the state’s largest GHG emitters to decrease the carbon intensity of their operations in-lieu of purchasing allowances. In addition, there are legal requirements to direct 30% of the allowance auction proceeds to mitigate consumer cost and invest 67% of the proceeds to transition the state to a clean energy economy. Because NYCI is an economy-wide program, it will cover all manner of entities. This includes businesses, not-for-profit organizations, government bodies, schools, universities, etc. The regulations will group entities into sectors, and each sector will have distinct rules that apply to entities operating within it. The major sectors that have been identified so far include:

- Electricity Generation

- Fuel Suppliers (natural gas, fuel oil, etc.)

- Energy-Intensive and Trade Exposed (paper, cement, etc.)

- Stationary Combustion of Fossil Fuels (hot water, heating, etc.)

- Waste / Landfill

- Wastewater

NYCI will further segment the entities within these sectors and identify whether they are:

- Non-obligated: Only required to report their GHG emissions for accounting against the state’s annual cap.

- Obligated: Required to report GHG emissions and purchase an equivalent number of allowances. Of note, NYSERDA has stated that fuel suppliers are expected to have obligations for all non-aviation fuel used in New York.

Impacts to NY Entities

Due to the varying regulations across the sectors, as well as the requirements still being in the design phase, forecasting how entities will be impacted in terms of reporting and budget will be challenging.

NYSERDA has sent a clear signal that fuel suppliers (natural gas, fuel oil) will be subject to allowance purchases for both operations and resulting downstream emissions. The likely result is that fossil fuel customers in the Stationary Combustion sector will not be subject to allowance purchases but will see higher fuel costs passed on to them. Naturally this is meant to motivate end use customers to transition to lower emissions sources like electric heat pumps. NYSERDA has also made it clear that the program will prioritize both disadvantaged communities and affordability in the regulatory design. This can be accomplished in a few ways including clean energy investments, and allowance set asides that aim to provide a just transition and protect the most “at risk” customers from cost impacts.

New York City Specific Impacts

One specific area of note that Rise is tracking is the interplay between New York City customers that are obligated under Local Law 97 (LL97) and whether that will be the final compliance mechanism for NYCI. While nothing official has been announced, NYSERDA President and CEO Doreen Harris stated at this month’s Urban Green conference that the intent is to have NYCI integrate with LL97. The outcome would be LL97 aimed at building emissions and NYCI on fuel suppliers that provide natural gas and fuel oil to buildings. NYC customers would then be heavily incentivized to convert to lower emissions sources to avoid both higher fuel costs and LL97 compliance penalties.

Current Status

NYCI is currently in the design phase and NYSERDA and the DEC are seeking feedback from all parties on program specifics. In addition, they are holding a series of twelve webinars to raise awareness and engage the stakeholder community.

Rise Energy is tracking the regulatory development and our internal view is that the program rules will be defined by the end of 2023, GHG reporting will be required in 2025 (based on 2024 emissions), and the first allowance purchases will be required in early 2025 (based on 2024 reported emissions). Key elements like the methodology for accounting GHG emissions (e.g.: will it be something like the Greenhouse Gas Protocol or more like the California Compliance market), what entities are obligated vs. non-obligated, what entities can participate in the allowance auction, and the penalties for non-compliance, are all still pending.

NYSERDA and DEC are being thoughtful in the design process and have established a process to provide feedback. Some example items they have highlighted as areas of interest include:

- How to ensure entities that are trade exposed (steel, cement, paper, etc.) do not become uncompetitive overnight.

- How should NYCI link to existing programs like the Regional Greenhouse Gas Initiative (RGGI) that already impose GHG regulations on the electric generation sector.

- Should the obligation for emissions tied to stationary sources (heat, hot water, etc.) be with the entity consuming fossil fuels or the entity providing the fuel.

- What should be considered when establishing thresholds for natural gas fuel suppliers and infrastructure owners.

- How quickly should the emissions cap decline between now and 2050?

For More Information

If you would like to sign-up to receive regular updates from Rise or for more information on the NYCI program, assistance calculating your entities GHG emissions or help understanding how the program will impact your budget, please contact:

Kevin George

Director of Sustainability and Client Services

June 2023