SUSTAINABILITY INSIGHTS

Can Renewable Natural Gas succeed outside compliance markets?

Renewable natural gas is viewed as a promising source of supply by states, utilities, and businesses to help reduce greenhouse gas emissions and move them closer to achieving their sustainability objectives. It’s promising because renewable natural gas or RNG is produced through the digestion of organic feedstocks (food scraps, wastewater, landfilled waste, animal manure) and not from drilling or mining geological deposits, like fossil natural gas. Capturing methane (CH4) from organic materials, that would otherwise be released into the atmosphere, is a very attractive proposition. Methane has a greenhouse warming potential that is 25x carbon dioxide over a 100-year timespan and 84x over 20 years. Anaerobic digesters create the environment for micro-organisms to digest these materials and create a medium BTU content (50-70% of natural gas) biogas. That biogas can be used directly in boilers to create heat, in reciprocating engines to create power, or can be further upgraded to remove carbon dioxide and other contaminants to make RNG, which is chemically identical to natural gas. It’s this last stage, the upgrading to “pipeline quality” natural gas which makes RNG so attractive. It means that RNG can be directly supplemented for NG in any application, what is referred to as a “drop in” fuel.There are currently over 200 producing renewable natural gas projects today and over 130 new projects under construction. Many more are under consideration or in the planning stage.

Low Carbon Fuel Standards and RNG

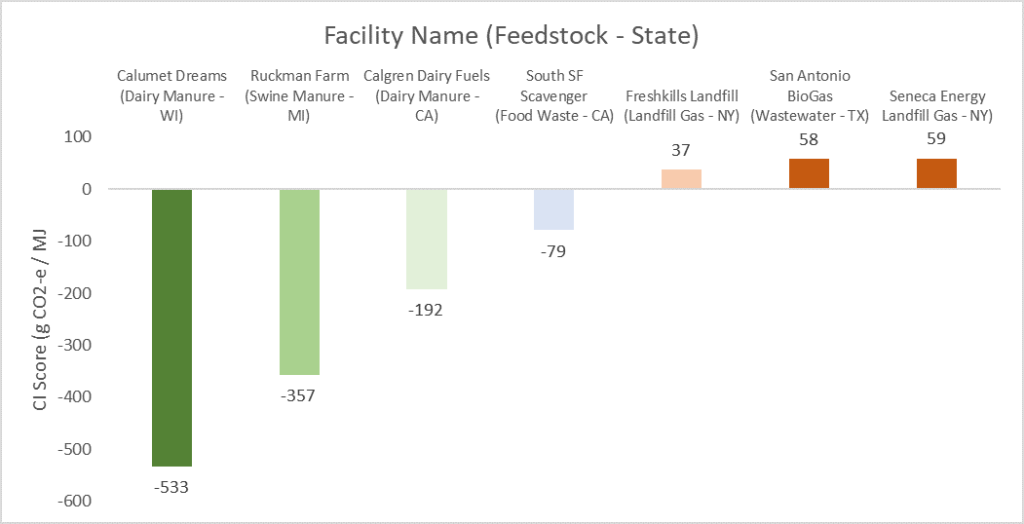

The primary catalyst behind increasing demand for renewable natural gas has been the California Low Carbon Fuel Standard (LCFS). California passed the LCFS in 2009 and implemented the program in 2011. It mandates the lowering of the carbon intensity of transportation fuels used in California by 20% by 2030. Without getting into all the details of the program, its enough to understand that carbon intensity (CI) scoring comes out of a model, which fully evaluates the GHG emissions impact of all activities involved in producing, transporting, and using a particular fuel in the state. Carbon intensity itself is expressed as grams of CO2e per megajoule of energy. The chart shows example CI scores for actual facilities producing compressed natural gas (CNG) to be used in a heavy-duty vehicle. Negative CI scores indicate that the entire process, including the ultimate combustion of the fuel in the vehicle, is removing more GHG emissions from the atmosphere than its contributing.

While its not critical to understand every aspect of the program, there are a couple of key points to remember. The first is that the state sets a CI baseline for transportation fuels each year and that the baseline gets lower each year. Fuel producers or importers whose fuel has a CI score below the baseline are eligible to generate (LCFS) credits and fuels with a CI score above the baseline generate (LCFS) deficits. The credits and deficits can be traded between parties or banked, with some limitations, to fully satisfy annual compliance obligations. The average value of these credits in 2021 was $188 per metric ton and the total value of LCFS transactions was $4.7 billion. While the California LCFS market covers a variety of transportation fuels, the impact it has had on RNG demand is clear. At the programs inception in 2011, 100% of CNG vehicle fuel was natural gas. In 2021, 95% of CNG vehicle fuel is renewable natural gas.

Federal Renewable Fuel Market

The Renewable Fuel Standard (RFS) program was created under the Energy Policy Act of 2005 and expanded by the Energy Independence and Security Act in 2009. The RFS, which is administered by the EPA, is a national program which requires that a certain percent of petroleum-based transportation fuels be replaced with renewable based fuels. The program is the reason why ethanol is blended into every gallon of gasoline. The RFS also provides clear incentives for producers of RNG, which they refer to as cellulosic biofuels. Renewable natural gas used in transportation anywhere in the United States, can qualify to earn RINs, which are analogous to credits under the California program. The RINs have a marketable value, can be traded, banked, or retired by compliance parties. There are clear differences between the Federal and California approach, namely that the RFS doesn’t use CI scoring to determine the number of RINs received but it does use feedstock to influence the type of RIN received by a renewable fuel provider.

Renewable natural gas was responsible for 98% of the cellulosic biofuel RINs generated in 2021, with a total quantity that will exceed 600 million gallons of ethanol equivalent. That means that slightly over 50 billion cubic feet of RNG was used in vehicle fuel and earned RINs under this program.

Beyond Compliance

Demand for RNG to meet compliance obligations under the Federal RFS program, the California LCFS program, and a similar program in Oregon, have provided clear incentives to expand supply of renewable natural gas over the past decade. However, the benefits of RNG extend beyond transportation fuels and there is also growing demand coming from utilities and businesses for a fuel with a lower carbon footprint than natural gas.

RNG as a GHG reduction tool

With 95% of SP 500 companies currently reporting their sustainability data and the majority of those having published emission reduction goals, there is broad support for fuels that have lower carbon footprints. However, the rules around how to treat RNG purchases under GHG reporting protocols could benefit from some refinement and additional clarity.The Greenhouse Gas Protocol, which is the worlds most widely used greenhouse gas accounting standard, does not mention renewable natural gas specifically. It does provide that “emissions data for direct CO2 emissions from biologically sequestered carbon (eg: biofuels) is reported separately from the scopes”. In essence, the reporting guidance would allow that 1 MMBtu of renewable natural gas would reduce a company’s ultimate reported GHG emissions equal to combusting 1 MMBtu of natural gas. This one for one treatment is a significant departure from the CI scoring method that is prevalent in renewable transportation fuel compliance markets and place voluntary RNG buyers at a disadvantage in the marketplace.

Utilities and RNG

Demand for RNG is also increasing with natural gas utilities, but it is unclear how large a role utilities will play in the long term as they are not the ultimate consumers. Today, we see a handful of utilities that have an approved Voluntary RNG Tariff available to customers in their service area, and several utilities that are pursuing a similar type of tariff. These tariffs make RNG an option that customers can elect if they are willing to pay a premium. Similar to renewable power tariffs, we expect these to have some traction with smaller customers, but larger consumers will most likely elect to negotiate their own supply arrangements, especially if there is a premium involved. Another approach is for utilities to be authorized by their state commissions to purchase RNG as a certain percentage of their overall supply mix. If widely adopted, this could have the potential to significantly impact overall demand. The authorized rate recovery mechanism would allow utilities to become a counterbalance to transportation compliance markets. Currently, twelve states have an approved RNG tariff or rate recovery and another nine states have regulations under consideration.

So where do we go from here?

The existing landscape for renewable natural gas is both promising and complicated. Not all RNG projects are the same and there are material differences in the way different buyers assess the overall value of RNG. Compliance markets are the clear driver today. We expect Low Carbon Fuel Standards to expand into new states, which will further increase demand for low CI fuels. Corporations recognize the potential that RNG represents to help them meet aggressive emission reduction goals, but high prices and the current state of GHG accounting standards remain an obstacle. Utilities could be the wild card and if state commissions begin adopting renewable thermal obligations like renewable portfolio standards (RPS), then we could see a significant new source of demand for renewable natural gas. It appears that while compliance obligations from state level Low Carbon Fuel programs will remain the primary driver of RNG demand, there is clear momentum among corporations and utilities to shift toward a renewable natural gas supply option.

January 2022